[ad_1]

Japan has a protracted historical past of alcohol consumption, with drinks like sake and shochu deeply ingrained in its tradition. Nonetheless, the nation is experiencing a change in ingesting habits. Persons are more and more choosing more healthy selections, resulting in an increase in low-alcohol and non-alcoholic drinks. Now let’s get to the Alcohol pattern in Japan.

Alcohol Development in Japan

Non-alcoholic bars are additionally on the rise and appear to be fashionable amongst Era Z. The pattern is altering to at least one the place individuals who drink and those that don’t drink can take pleasure in themselves of their approach. The methods of having fun with alcohol have gotten extra various. There was a noticeable enhance within the number of craft beers, initially influenced by a growth in the US, with home manufacturers like Kirin’s Spring Valley actively collaborating. These craft beers, together with others like BREWDOG’s Neon Dream, are significantly interesting to youthful demographics ,(20-30 yrs. outdated) together with girls.

Moreover, there’s a rising pattern of fruity shochu, like Daiyome with its lychee scent, and the rise of “non-sweet alcohol” choices that pair effectively with meals, reflecting a rise in dwelling ingesting. Standard merchandise akin to Midori Gin Soda, Tako Highball, and sugar-free sours are gaining traction. There was a rising recognition of Japanese wine, noting enhancements in winemaking methods, a wide range of grapes, and the comfort of canned wines with single-serving sizes, that are straightforward to recycle.

Low-alcoholic and non-alcoholic drinks

Low-alcoholic and non-alcoholic drinks are alcoholic drinks with little or no or no alcohol, providing related tastes with out the excitement.

Non-sweet alcohol

Non-sweet alcohol is alcoholic drinks which have a dry or much less candy taste in comparison with sweeter choices. In recent times, increasingly persons are involved about carbohydrates, and non-sweet alcoholic drinks are the brand new pattern this yr.

Suntory Midori Gin Soda 350ml

Suntory Kodawari Sakaba no Tako Highball

Japanese Wine

Japanese Wine is a wine produced in Japan, typically with distinctive grape varieties and flavors. Additionally hold an eye fixed out for Japanese wine, the standard of which is consistently bettering.

Chateau Mercian Aiakane 75ml

Craft beer

Craft beer is beer made by small unbiased breweries, specializing in distinctive tastes and substances. It’s changing into increasingly fashionable yearly, and this recognition reveals no indicators of slowing down!

BREWDOG NEON DREAM

Kirin Spring Valley JAPAN ALE (Kaori)

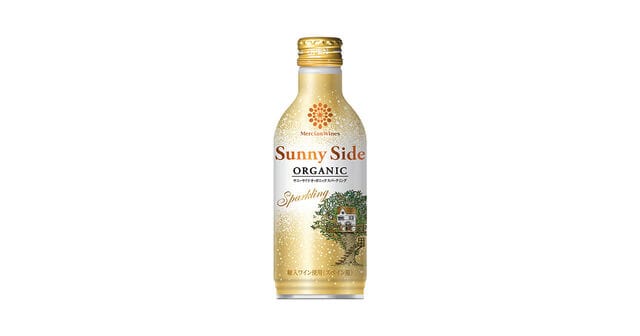

Canned wine

Canned wine is wine packaged in cans, handy and excellent for on-the-go enjoyment. This additionally suits the pattern in direction of sustainability, is on the rise!

Mercian Wines Sunnyside Natural Glowing Can

Fruity shochu

Fruity shochu is a Japanese distilled spirit with a candy and fruity taste, typically loved blended with water or soda. Additionally, you will be enlightened to the deliciousness of shochu! Even those that have by no means tried it could develop into addicted.

Hamada Sake Brewery Daiyame ~DAIYAME

October for the New Regulation to take impact

In 2024, Japan’s alcohol market has seen important modifications, with a decline in gross sales of robust alcoholic drinks (round 9% alcohol content material) that had been as soon as fashionable for being low-cost and flavorful. This shift comes amid rising opposition to alcohol promoting in public areas, and a brand new legislation taking impact in October will ban ingesting on the streets in Tokyo’s Shibuya district. This can be a transfer that many consider will quickly be adopted in different areas like Shinjuku. The brand new revision on the Liquor Tax Regulation can even lowered the worth of beer whereas growing the price of happoshu and third-category beer, resulting in a unified tax price by 2026.

What is going on within the Alcohol markets in Japan?

Sturdy chu-hai, a preferred alcoholic beverage amongst younger adults in Japan, is fashionable for its excessive alcohol content material, affordability, and various flavors. Nonetheless, in January 2024, the Ministry of Well being, Labor, and Welfare issued tips to lift consciousness concerning the widespread consumption of those robust drinks. Because of this, beer firms like Asahi and Sapporo have drastically lowered their robust chu-hai product choices.

On the identical time, the demand for non-alcoholic drinks is on the rise. Suntory reported that the non-alcoholic beverage market grew by 2% in 2022 in comparison with 2021, marking a 40% enhance over the previous decade. In the meantime, gross sales of robust chu-hai have considerably declined, dropping from ¥177.6 billion JPY ($1.1 billion USD) in 2020 to ¥136.5 billion ($853 million) in 2023.

Market Share and Tendencies by alcohols in Japan

Beer (37%)

- Spending: $39.9 billion

- Development: There’s a rising demand for craft beer, pushed by customers looking for distinctive and high-quality choices. Manufacturers like Kirin’s Spring Valley and BREWDOG’s Neon Dream are significantly interesting to youthful demographics.

Shochu (24%)

- Spending: $25.9 billion

- Development: Shochu stays a staple in Japanese tradition, with a gradual demand. There may be additionally an growing curiosity in premium and aged shochu varieties.

Sake (15%)

- Spending: $16.2 billion

- Development: Sake continues to carry robust cultural significance. There’s a pattern in direction of premium sake and revolutionary packaging, making it extra accessible to youthful customers.

Whisky (10%)

- Spending: $10.8 billion

- Development: Japanese whisky is famend globally, and its recognition continues to develop. There’s a give attention to high-quality, aged whiskies, and restricted editions.

Wine (8%)

- Spending: $8.6 billion

- Development: The standard of Japanese wine is bettering, with a wide range of grapes and handy canned choices. There may be additionally a rising curiosity in natural and pure wines.

Different Spirits (6%)

- Spending: $6.4 billion

- Development: Non-sweet alcohol choices like Suntory Midori Gin Soda and Tako Highball are gaining traction. There may be additionally an growing desire for low-alcohol and non-alcoholic drinks, pushed by well being and wellness developments.

Complete Market

- Complete Income: $107.8 billion

- Complete Quantity: 8.21 billion liters

These figures replicate the mixed income from each at-home and out-of-home consumption of alcoholic drinks in Japan. The market is predicted to develop yearly by 0.94% from 2024 to 2029.

Takeaway

Alcohol pattern in Japan is altering, with a transfer away from conventional robust drinks in direction of low-alcohol and non-alcoholic choices, pushed by a shift in direction of more healthy life. The trade is adapting with revolutionary merchandise, although challenges like financial circumstances and regulatory modifications stay. Development alternatives lie in area of interest markets and new beverage classes, with the way forward for the market relying on balancing custom with innovation to satisfy evolving client tastes.

A few of our suggestion for different Japanese drinks/meals under!

Suntory Whiskey is an iconic identify synonymous with the wealthy custom and innovation of Japanese whiskey-making. Famend for its various vary of f…

[ad_2]